Sold Merchandise on Account Terms 2/10 N/30

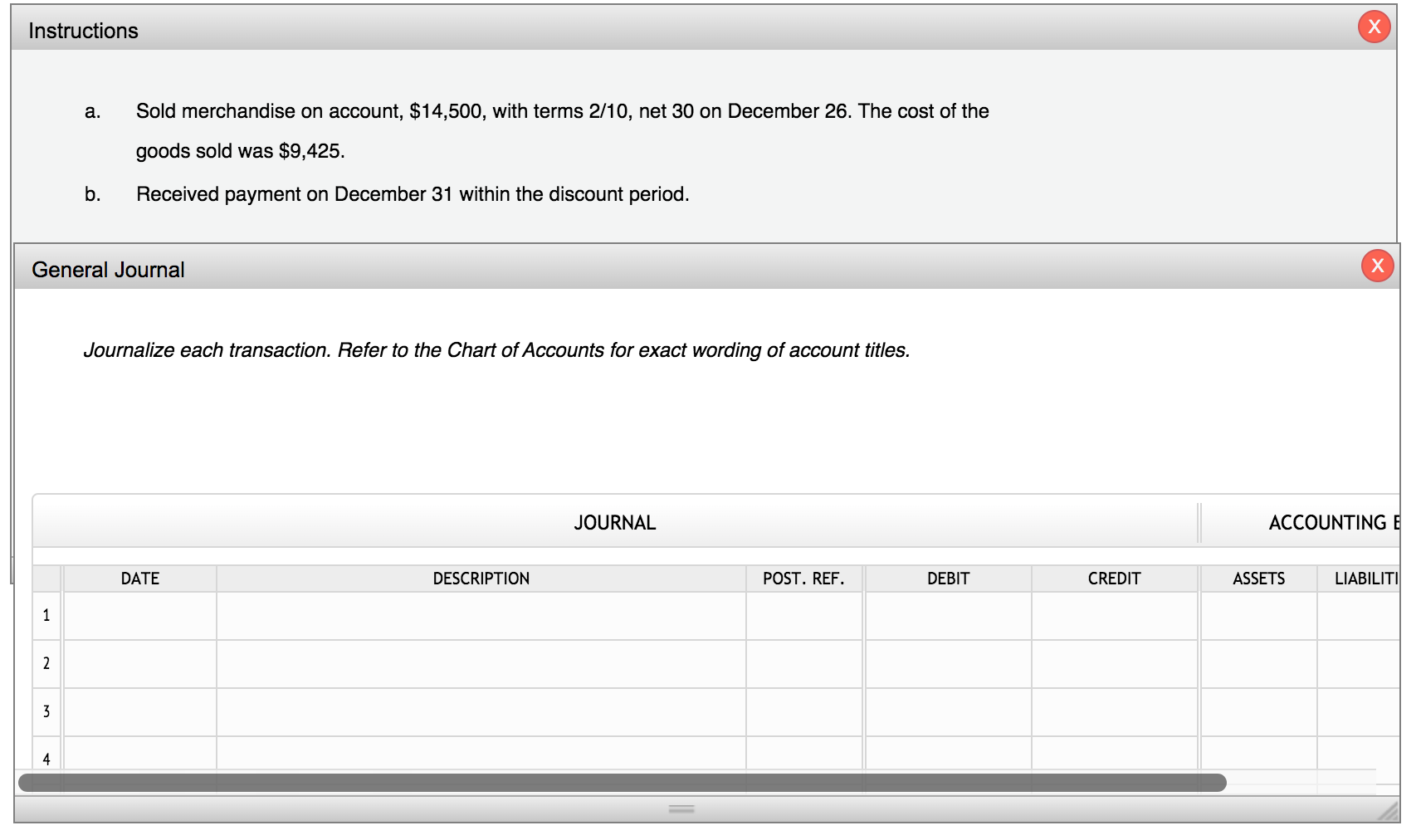

If required round your answers to two decimal places. 111560 CREDIT cash 111560.

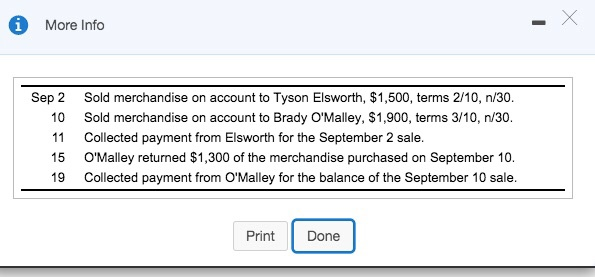

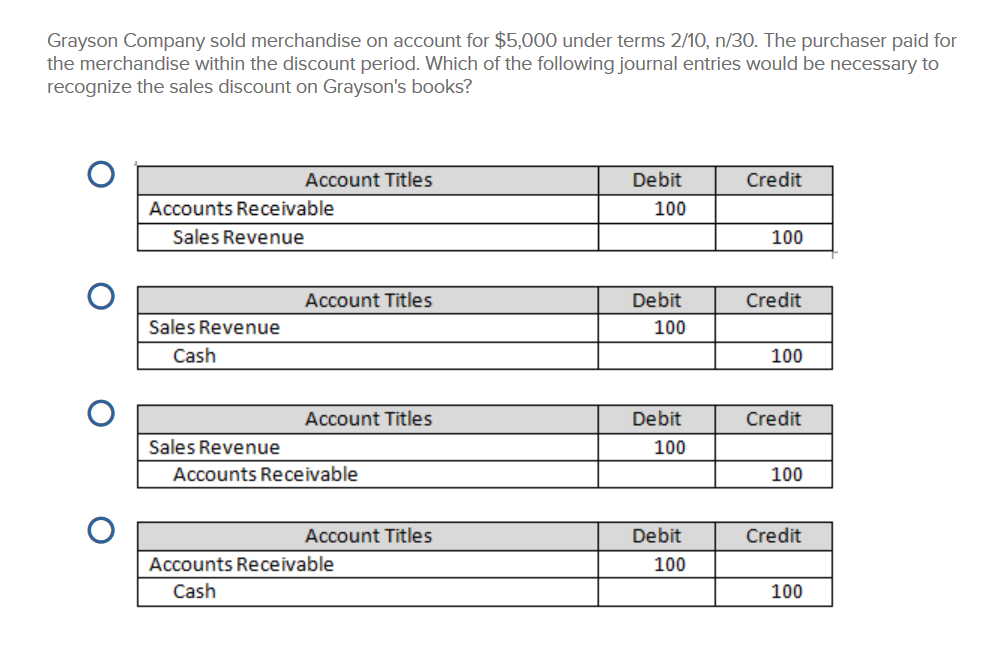

Solved More Info Sep 2 10 11 15 19 Sold Merchandise On Chegg Com

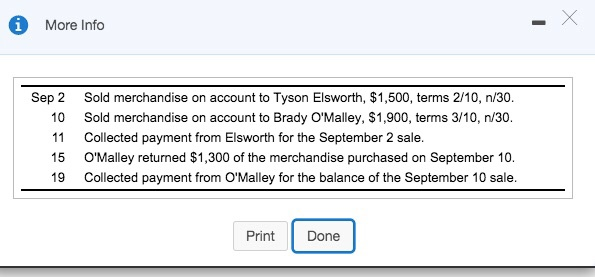

2 EE 6-3 Journalize the following merchandise transactions.

. The customer agreed to keep the merchandise. The cost of the merchandise sold was 55500. 05292020 Business College answered g Sayers Co.

Sold merchandise on account to a customer for 80000 terms 210 n30. Amount received within the discount period. Journalize Sayers entries to record the sale using the net method under a perpetual inventory system.

Sales-related transactions Sayers Co. Paid freight of 1800. Find Original Price 92500 Step 2.

Sold merchandise to Blue Star Co. Issued a 500 credit memo for damaged merchandise. On account 25500 terms 215 net 45.

Received payment less the discount. Amount debited to Accounts Receivable c. On March 2 Sunland Company sold 997000 of merchandise on account to Culver Company terms 310 n30.

Credit account titles are automatically indented when amount is entered. Sold merchandise on account to Korman Co terms 210 n30 FOB shipping point 68500. Debit Accounts Receivable 80000 Credit Revenue 80000 b.

6 Received credit from Walker Supply for merchandise returned 500. The cost of the merchandise sold was 32000. Paid the amount owed on the invoice within the discount period.

The cost of the merchandise sold was 41000. Accounting for Merchandising Operations Information related to Kerber Co. If an amount box does not require an entry leave it blank.

Accounts Receivable - Tabor Co. Sales Revenue 4400 to record credit sale Dr. Received 22300 cash from Halstad Co.

May 2 Sold merchandise on account for 4400 terms 210 n30. Accounts Receivable Debit 91575 Sales Credit 91575 How to get there. The cost of the merchandise sold is 67200.

2 The following selected transactions were completed by Amsterdam Supply Co which sells office supplies primarily to wholesalers and occasionally to retail customers. Received collections in full less discounts from customers billed on sales of 2100 on May 2. Amount of the sale b.

- Sold merchandise on account to Tabor Co 16650 terms 210 n30. Paid Brauns Wholesale Supply in full less discount. Cost of Merchandise Sold 10000 Credit.

Sold merchandise on account to a customer for 80000 terms 210 n30. Sold merchandise to Blue Star Co. The payment terms are 210 n30 and the invoice is dated August 1.

Journalize Sayers entries to record the sale using the net method under a perpetual inventory system. Sold merchandise on account 2100 terms 110 n30. 16000 C The primary difference between the periodic and perpetual inventory systems is that a.

On March 15 Monroe Sales sells 9525 on account to Garrison Brewer with terms of 210 n30. 2 Purchased merchandise on account from Walker Supply 6200 terms 110 n30. PR 6-2A Sales-Related Transactions Using Perpetual Inventory System OBJ.

Paid freight of 1800. Sold merchandise that cost 12250 to customers for 17500 on account with terms 210 n30. Assume all discounts are taken.

In the first entry both Accounts Receivable debit and Sales credit increase by 16800 300 56. Is presented below On April 5 purchased merchandise from Wilkes Company for 23000 terms 210 net30 FOB shipping point On April 6 paid freight costs of 900 on merchandise purchased from Wilkes. Discovered that 11000 of the merchandise purchased in a was defective and returned items receiving credit for 10780 11000 11000 2.

The cost of the merchandise sold was 583000. The terms of 210 n30 means 2 discount for the payment within 10 days and the full amount to be paid within 30 days. Instructions Journalize the entries to record the transactions of Capers Company for October.

Do not indent manually Account Titles and Explanation Debit Credit 997000 997000 eTextbook and Media List of Accounts. Inventory 3300 to record cost of merchandise sold May 5 Received credit from Black Wholesale Supply for merchandise returned 200. Debit Cost of good sold 58000 Credit Merchandise 58000 2.

- Sold merchandise for cash 91 200. Sold merchandise on account 92500 with terms 110 n30. The cost of the merchandise sold is 67200.

The cost of the merchandise sold was 56900. These credit terms are a little different than the earlier example. Paid the invoice within the discount period.

The cost of the merchandise sold was 1300. Sold merchandise there are 2 entries record the sales. Payment of the amount due DEBIT accounts payable - shore co.

Sold merchandise for cash 54000. Find Discount 1 92500 x 001 925 Step 3. On account terms 210 n30.

1 discount if paid within 10 days net amount due within 30 days. The cost of merchandise sold was 6905. The cost of the merchandise sold was 3300.

Sold merchandise on account to a customer for 86000 terms 210 n30. Journalize the receipt of payment within the discount period. The seller paid the freight of 590.

Paid for merchandise purchased on May 3. Journalize Blue Star Cos entries for the. The cost of the merchandise sold was 3400.

If an amount box does not require an entry leave it blank. Accounts Receivable 4400 Cr. PE 6-3B Sales Transactions OBJ.

On account 112000 terms FOB shipping point 210 n30. On April 7 purchased equipment on account for 26000. Received credit from Brauns Wholesale Supply for merchandise returned 300.

A Journalize the sale and the recognition of the cost of the sale. Sales related transactions Sayers Co. Returned 1050 of defective merchandise from the September 1 purchase to the supplier.

On account 112000 terms FOB shipping point 210 n30. For the sale purchase and payment of amount due. Sold merchandise to Pound Co.

The cost of the goods sold was 58000. 5 Paid 240 freight on April 4 sale. The cost of the goods sold was 58000.

The cost of the merchandise sold was 10000. Purchased 57000 of merchandise from Foster Co. 4 Sold merchandise on account 5500 FOB desinaion terms 110 n30.

Journalize the entries for Shore Co. The cost of the goods sold was 63000. B On March 20 a 125 credit memo is given to Garrison Brewer due to.

Sold merchandise on account 94800 with terms 210 n30. Journalize Sayers entries to record the sale. What is the sales amount to be recorded in the above transactions.

The following entries occur. Received cash from customers of September 8 sale in settlement of the account balances but not within the. Merchandise is sold on account to a customer for 14100 terms FOB shipping point 210 n30.

Cost of goods sold 3300 Cr. Paid cash for the balance due on the merchandise purchased on September 1. The cost of the merchandise sold was 55000.

Assume all discounts are taken. And Blue Star Co.

Solved Instructions A Sold Merchandise On Account 14 500 Chegg Com

Solved May 1 Paid Rent For May 5 000 3 Purchased Chegg Com

Solved Grayson Company Sold Merchandise On Account For Chegg Com

Comments

Post a Comment